Gift 2025 Limit. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. The annual gift tax exclusion is $18,000 for 2025 and will be $19,000 in 2025.

However, if your gift exceeds $18,000 to any person during the year, you have to report it on a gift tax return (irs form 709). And the “gift planning” column assumes adam and barb use their.

IRS Increases Gift and Estate Tax Thresholds for 2025, The gift tax limit (also known as the gift tax exclusion) is $18,000 for 2025.

Annual Gift Tax Limit 2025 Aleda Aundrea, Gift tax limit 2025 the irs recently announced increases in gift and estate tax exemptions for 2025.

IRS Limits on Retirement Benefits and Compensation EisnerAmper Wealth, This is the spirit of the two of wands, the vibe we want to lean into throughout 2025.

Gift Tax Amount 2025 Hayley Auberta, For married couples, the limit is $18,000 each, for a total of $36,000.

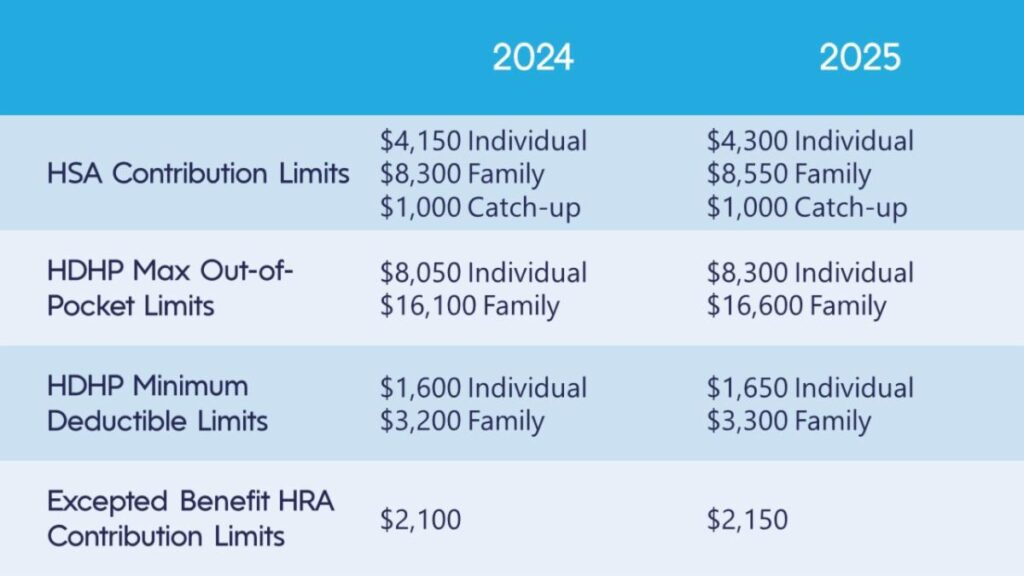

Hsa Account Contribution Limit 2025 Cymbre Oralie, The unified estate and gift tax exclusion amount, $13,610,000 for gifts made and decedents dying.

IRS Announces Increases to HSA Contribution Limits and More for 2025, At its general core, the federal gift tax annual exclusion allows taxpayers to transfer relatively significant sums to their children or other beneficiaries each year without.

Gift Tax Limit 2025 Per Person Danell Kalindi, Gift tax limit 2025 the irs recently announced increases in gift and estate tax exemptions for 2025.

Irs Gift Limit 2025 Joell Madalyn, The “basic exclusion amount” rises to $13.99 million per person in 2025, up from $13.61 million in.

Copa America 2025 Fixtures Pdf Download. Find out the groups, schedules,. Learn everything about the 16 team competition that will[...]

Buffalo 2025 Halloween Parties. There are lots of fun haunted and halloween events happening across buffalo and western new york[...]

Free Clipart 2025 Graduation. New users enjoy 60% off. Free for commercial use high quality images 1,871 free images of[...]